MONTREAL, Canada, March 14, 2016 – Amaya Inc. (NASDAQ: AYA; TSX: AYA) today reported financial results for the fourth quarter and year ended December 31, 2015 and provided a performance update for the first two months of 2016. Unless otherwise noted, all dollar ($) amounts are in Canadian dollars.

“Throughout 2015 we successfully executed on our strategy of diversifying our operations while maintaining market dominance in poker,” said David Baazov, Amaya Chairman and CEO. “Despite significant foreign exchange and product rollout challenges, we achieved positive growth on a constant currency basis and, through investments and initiatives that will continue through 2016, have laid the foundation for becoming a leader across multiple gaming verticals.”

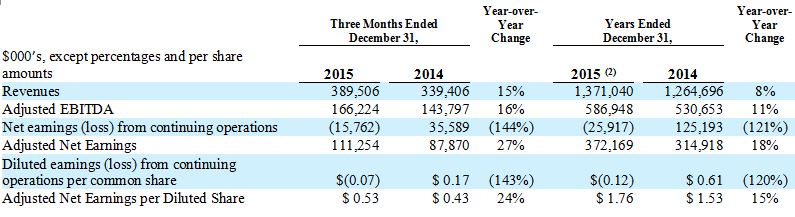

Fourth Quarter and Full Year 2015 Financial Summary(1)

__________________________________________________

(1) For important posed corporate name change and related matters, reconfirmed full year 2017 financial guidance ranges and provided certain additional highlights and updates. Unless otherwise noted, all dollar ($) amounts are in U.S. dollars.

“We continued our momentum in the first quarter as we execute on our strategy and reinforce the foundation for sustainable and diversified revenue growth, including through the strengthening of our core management team and operations,” said Rafi Ashkenazi, Chief Executive Officer. “Our company also continues to evolve through corporate initiatives to deliver the greatest value for our shareholders.”

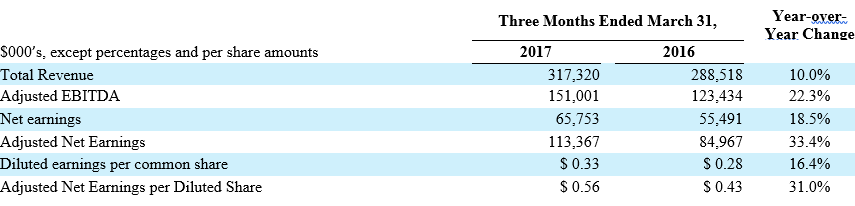

First Quarter 2017 Financial Summary(1)

(1) For important information on Amaya’s non-IFRS measures, see below under “Non-IFRS and Non-U.S. GAAP Measures” and the tables under “Reconciliation of Non-IFRS Measures to Nearest IFRS Measures”.

First Quarter 2017 and Subsequent Financial Highlights

- Revenues - Total revenues for the quarter increased approximately 10.0% year-over-year. Excluding the impact of year-over-year changes in foreign exchange rates, total revenues for the quarter would have increased by approximately 9.9%. Real-money online poker revenues and real-money online casino and sportsbook combined revenues represented approximately 68.9% and 27.3% of total revenues for the quarter, respectively, as compared to approximately 75.0% and 20.8% for the prior year period.

- Poker Revenues – Real-money online poker revenues for the quarter were $218.7 million, or an increase of approximately 1.1% year-over-year. Excluding the impact of year-over-year changes in foreign exchange rates, real-money online poker revenues would have increased by approximately 0.3% for the quarter.

- Debt – Total long term debt outstanding at the end of the quarter was $2.53 billion with a weighted average interest rate of 4.5%. In March 2017, Amaya announced the successful repricing and retranching of its U.S. dollar and Euro denominated first lien term loans resulting in the reduction of the applicable interest rate margins by 50 basis points, removing the Euribor floor on the Euro denominated first lien term loans, and raising €100 million of incremental Euro denominated first lien debt and using the same to reduce its U.S. denominated first lien debt. As a result, the weighted average interest rate on the long term debt decreased approximately 0.4% and Amaya currently expects to save approximately 13%, or $15.4 million, of interest expense annually. Amaya and the lenders also amended the credit agreement for its first lien term loans to, among other things, reflect the repricing, retranching, and waive the required 2016 and 2017 excess cash flow repayments (as defined and described in the credit agreement) previously due on March 31, 2017 and March 31, 2018, respectively.

- Rational Group Deferred Payment – Amaya paid $75 million in January 2017 and an additional $75 million in April 2017 on the outstanding balance of the deferred purchase price for its acquisition of the Rational Group and continues to anticipate paying the remaining $47.5 million by the end of June 2017 using cash on its balance sheet and cash flow from operations.

First Quarter 2017 and Subsequent Operational Highlights

- Quarterly Real-Money Active Uniques (QAUs) – Total combined QAUs were approximately 2.7 million, an increase of approximately 5% year-over-year primarily led by customer acquisition, engagement and reactivation initiatives. Approximately 2.5 million of such QAUs played online poker during the quarter, an increase of approximately 2% year-over-year, while Amaya’s online casino offerings had approximately 664,000 QAUs, an increase of approximately 42% year-over-year, which Amaya continues to estimate is one of the largest casino player bases among its competitors. Amaya’s emerging online sportsbook offerings had approximately 277,000 QAUs, a 64% increase year-over-year.

- Quarterly Net Yield (QNY) – Total QNY and QNY excluding the impact of year-over-year changes in foreign exchanges rates were both $115, an increase of 5.4% year-over-year in each case. QNY is a non-IFRS measure.

- Customer Registrations – Customer Registrations increased by 3.0 million during the quarter to approximately 111 million.

- Chief Financial Officer Update – In January 2017, Amaya announced that its CFO, Daniel Sebag, advised it that he will retire as CFO later this year once his successor is identified and appointed, and will assist Amaya in ensuring an orderly transition of his duties. The Board and leading executive recruiting firm Spencer Stuart commenced a global CFO search and Amaya is in the final stages of the hiring process with respect to a potential candidate.

- Appointment of Chief Corporate Development Officer – On May 11, 2017, Amaya announced the appointment of Robin Chhabra to the newly created position of Chief Corporate Development Officer. Mr. Chhabra is an experienced online gaming executive who most recently served as Group Director of Strategy and Corporate Development for William Hill plc (LSE: WMH). Amaya anticipates Mr. Chhabra will join the company in September 2017 following a brief garden leave from William Hill.

Corporate Name Change and Continuance

Amaya currently intends to include in its management information circular for its upcoming 2017 annual and special meeting of shareholders, among other things, the following special matters:

- Corporate Name Change –Amaya intends to change its corporate name to “The Stars Group Inc.”

- Continuance – To more effectively manage its business and affairs, Amaya also intends to effect a

continuance under the Business Corporations Act (Ontario) such that it will become an Ontario

corporation and subject to such act. Following the continuance and appointment of its new CFO, Amaya

intends to move its corporate head office to Toronto, Ontario.

Additional information regarding the business of the meeting and the matters to be considered and voted

on by the shareholders at the meeting will be provided in the management information circular.

Full Year Guidance

- Full Year Guidance – Amaya reconfirms its previously announced 2017 full year financial guidance

ranges and continues to expect the following:

o Revenues of $1,200 to $1,260 million;

o Adjusted EBITDA of $560 to $580 million;

o Adjusted Net Earnings of $400 to $430 million; and

o Adjusted Net Earnings per Diluted Share of $1.94 to $2.13.

These estimates reflect management’s view of current and future market and business conditions, including

assumptions of (i) the cessation of real-money online poker offering in Australia by the end of June 2017

(previously believed to be April 2017), (ii) the introduction of Amaya’s previously disclosed

cross-vertical customer loyalty program, (iii) no other material adverse regulatory events and (iv) no

material foreign currency exchange rate fluctuations, particularly against the Euro which is the primary

depositing currency of Amaya’s customers, that could negatively impact customer purchasing power as it

relates to Amaya’s U.S. dollar denominated product offerings. Such guidance is also based on a Euro to

U.S. dollar exchange rate of 1.06 to 1.00, unaudited expected results and certain accounting

assumptions.

Financial Statements, Management’s Discussion and Analysis and Additional Information; Internal

Control Over Financial Reporting

As previously disclosed, management identified internal control deficiencies that constitute individually, or in the aggregate, material weaknesses in Amaya’s internal control over financial reporting as of December 31, 2016. These deficiencies relate to the operating effectiveness of controls over derivative valuations and hedge accounting, and the design of controls over foreign exchange rate information. Amaya continues to take steps to remediate these deficiencies and currently expects such remediation to be complete by the end of the second quarter of 2017. There were no restatements or adjusting entries required in Amaya’s unaudited condensed consolidated financial statements for the three months ended March 31, 2017 (the “Q1 2017 Financial Statements”) or otherwise as a result of the foregoing. For additional information, see “Disclosure Controls and Procedures and Internal Control Over Financial Reporting” in Amaya’s management’s discussion and analysis for the year ended December 31, 2016 (the “2016 MD&A”) and in Amaya’s management’s discussion and analysis for the three months ended March 31, 2017 (the “Q1 2017 MD&A”).

The Q1 2017 Financial Statements, Q1 2017 MD&A and 2016 MD&A, as well as additional information relating to Amaya and its business, can be found on SEDAR at www.sedar.com, Edgar at www.sec.gov and Amaya’s website at www.amaya.com.

In addition to press releases, securities filings and public conference calls and webcasts, Amaya intends to use its investor relations page on its website as a means of disclosing material information to its investors and others and for complying with its disclosure obligations under applicable securities laws. Accordingly, investors and others should monitor the website in addition to following Amaya’s press releases, securities filings and public conference calls and webcasts. This list may be updated from time to time.

Conference Call and Webcast

Amaya will host a conference call today, May 12, 2017 at 8:30 a.m.

ET to discuss its financial results for the first quarter 2017 and related matters. Rafi Ashkenazi, Chief

Executive Officer of Amaya, will chair the call. To access via tele-conference, please dial +1

877-407-0789 or +1 201-689-8562 ten minutes prior to the scheduled start of the call. The playback will be

made available two hours after the event at +1 844-512-2921 or +1 412-317-6671. The Conference ID number

is 13661536. To access the webcast please use the following link:

http://public.viavid.com/index.php?id=124280

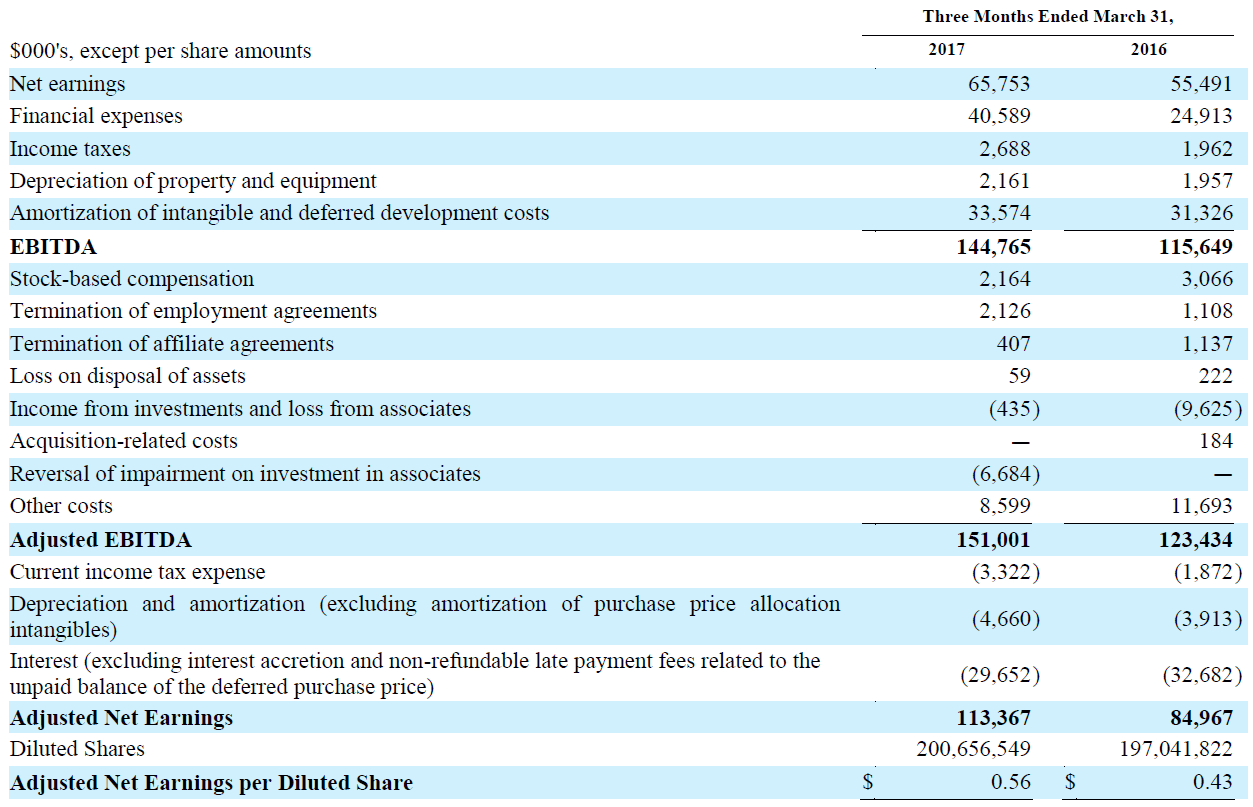

Reconciliation of Non-IFRS Measures to Nearest IFRS Measures

The table below presents

reconciliations of Adjusted EBITDA, Adjusted Net Earnings and Adjusted Net Earnings per Diluted Share to

the nearest IFRS measures:

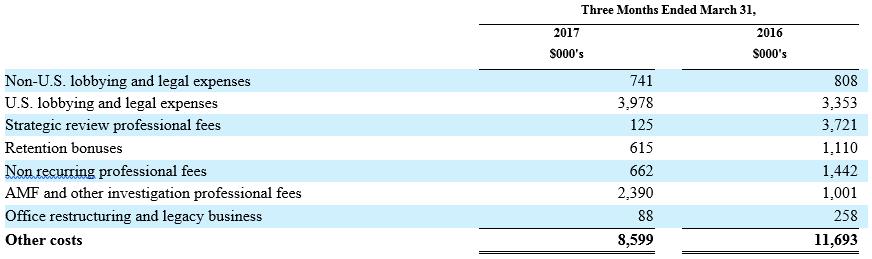

The table below presents certain items comprising “Other costs” in the reconciliation table above:

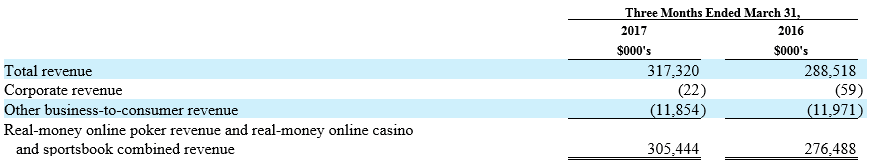

The table below presents a reconciliation of the numerator of

QNY (i.e., real-money online poker revenue and real-money online casino and sportsbook combined revenue)

to the nearest IFRS measure (i.e., total revenue) as reported for the applicable period. Unless otherwise

noted, any deviation in the reconciliation below to measures presented herein may be the result of

immaterial adjustments made in later periods due to certain accounting reallocations.

Amaya has not provided a reconciliation of the non-IFRS measures to the nearest IFRS measures included in its full year 2017 financial guidance provided in this release, including Adjusted EBITDA, Adjusted Net Earnings and Adjusted Net Earnings per Diluted Share, because certain reconciling items necessary to accurately project such IFRS measures, particularly net earnings (loss), cannot be reasonably projected due to a number of factors, including variability from potential foreign exchange fluctuations impacting financial expenses, and the nature of other non-recurring or one-time costs (which are excluded from non-IFRS measures but included in net earnings (loss)), as well as the typical variability arising from the audit of annual financial statements, including, without limitation, certain income tax provision accounting, and related accounting matters.

For additional information on Amaya’s non-IFRS measures, see below and the Q1 2017 MD&A, including

under the headings “Management’s Discussion and Analysis” and “Selected Financial Information—Other

Financial Information”.

About Amaya

Amaya is a leading provider of technology-based products and services in the global gaming and

interactive entertainment industries. Amaya ultimately owns gaming and related consumer businesses and

brands including PokerStars, PokerStars Casino, BetStars, Full Tilt, StarsDraft, and the PokerStars

Championship and PokerStars Festival live poker tour brands (incorporating aspects of the European Poker

Tour, PokerStars Caribbean Adventure, Latin American Poker Tour and the Asia Pacific Poker Tour). These

brands have more than 111 million cumulative registered customers globally and collectively form the

largest poker business in the world, comprising online poker games and tournaments, sponsored live poker

competitions, marketing arrangements for branded poker rooms in popular casinos in major cities around the

world, and poker programming and content created for television and online audiences. Amaya, through

certain of these brands, also offers non-poker gaming products, including casino, sportsbook and daily

fantasy sports. Amaya, through certain of its subsidiaries, is licensed or approved to offer, or offers

under third party licenses or approvals, its products and services in various jurisdictions throughout the

world, including in Europe, both within and outside of the European Union, the Americas and elsewhere. In

particular, PokerStars is the world’s most licensed online gaming brand, holding licenses or related

operating approvals in 17 jurisdictions.

Cautionary Note Regarding Forward Looking Statements

This news release contains forward-looking statements and information within the meaning of the Private

Securities Litigation Reform Act of 1995 and applicable securities laws, including, without limitation,

certain financial and operational expectations and projections, such as full year 2017 financial guidance,

certain future operational and growth plans and strategies, including, without limitation, the payment of

the deferred purchase price for the acquisition of the Rational Group, and CFO succession plans, including

the timing thereof. Forward-looking statements and information can, but may not always, be identified by

the use of words such as “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”,

“predict”, “potential”, “targeting”, “intend”, “could”, “might”, “would”, “should”, “believe”,

“objective”, “ongoing” and similar references to future periods or the negatives of these words and

expressions. These statements and information, other than statements of historical fact, are based on

management’s current expectations and are subject to a number of risks, uncertainties, and assumptions,

including market and economic conditions, business prospects or opportunities, future plans and

strategies, projections, technological developments, anticipated events and trends and regulatory changes

that affect us, our customers and our industries. Although Amaya and management believe the expectations

reflected in such forward-looking statements and information are reasonable and are based on reasonable

assumptions and estimates, there can be no assurance that these assumptions or estimates are accurate or

that any of these expectations will prove accurate. Forward-looking statements and information are

inherently subject to significant business, regulatory, economic and competitive risks, uncertainties and

contingencies that could cause actual events to differ materially from those expressed or implied in such

statements. Specific risks and uncertainties include, but are not limited to: the heavily regulated

industry in which Amaya carries on business; interactive entertainment and online and mobile gaming

generally; current and future laws or regulations and new interpretations of existing laws or regulations

with respect to online and mobile gaming; potential changes to the gaming regulatory scheme; legal and

regulatory requirements; ability to obtain, maintain and comply with all applicable and required licenses,

permits and certifications to distribute and market its products and services, including difficulties or

delays in the same; significant barriers to entry; competition and the competitive environment within

Amaya’s addressable markets and industries; impact of inability to complete future acquisitions or to

integrate businesses successfully; ability to develop and enhance existing products and services and new

commercially viable products and services; ability to mitigate foreign exchange and currency risks;

ability to mitigate tax risks and adverse tax consequences, including, without limitation, the imposition

of new or additional taxes, such as value-added and point of consumption taxes, and gaming duties; risks

of foreign operations generally; protection of proprietary technology and intellectual property rights;

ability to recruit and retain management and other qualified personnel, including key technical, sales and

marketing personnel; defects in Amaya’s products or services; losses due to fraudulent activities;

management of growth; contract awards; potential financial opportunities in addressable markets and with

respect to individual contracts; ability of technology infrastructure to meet applicable demand; systems,

networks, telecommunications or service disruptions or failures or cyber-attacks; regulations and laws

that may be adopted with respect to the Internet and electronic commerce and that may otherwise impact

Amaya in the jurisdictions where it is currently doing business or intends to do business; ability to

obtain additional financing on reasonable terms or at all; refinancing risks; customer and operator

preferences and changes in the economy; dependency on customers’ acceptance of its products and services;

consolidation within the gaming industry; litigation costs and outcomes; expansion within existing and

into new markets; relationships with vendors and distributors; and natural events. Other applicable risks

and uncertainties include, but are not limited to, those identified in Amaya’s Annual Information Form for

the year ended December 31, 2016, including under the heading “Risk Factors and Uncertainties”, and in the

Q1 2017 MD&A, including under the headings “Risk Factors and Uncertainties”, “Limitations of Key

Metrics and Other Data” and “Key Metrics”, each available on SEDAR at www.sedar.com, EDGAR at www.sec.gov

and Amaya’s website at www.amaya.com, and in other filings that Amaya has made and may make with

applicable securities authorities in the future. Investors are cautioned not to put undue reliance on

forward-looking statements or information. Any forward-looking statement or information speaks only as of

the date hereof, and Amaya undertakes no obligation to correct or update any forward-looking statement,

whether as a result of new information, future events or otherwise, except as required by applicable

law.

Non-IFRS and Non-U.S. GAAP Measures

This news release references non-IFRS and non-U.S. GAAP financial measures, including QNY, Adjusted

EBITDA, Adjusted Net Earnings, Adjusted Net Earnings per Diluted Share, and the foreign exchange impact on

revenues (i.e., constant currency). Amaya believes these non-IFRS and non-U.S. GAAP financial measures

will provide investors with useful supplemental information about the financial performance of its

business, enable comparison of financial results between periods where certain items may vary independent

of business performance, and allow for greater transparency with respect to key metrics used by management

in operating its business. Although management believes these financial measures are important in

evaluating Amaya, they are not intended to be considered in isolation or as a substitute for, or superior

to, financial information prepared and presented in accordance with IFRS or U.S. GAAP. They are not

recognized measures under IFRS or U.S. GAAP and do not have standardized meanings prescribed by IFRS or

U.S. GAAP. These measures may be different from non-IFRS and non-U.S. GAAP financial measures used by

other companies, limiting its usefulness for comparison purposes. Moreover, presentation of certain of

these measures is provided for year-over-year comparison purposes, and investors should be cautioned that

the effect of the adjustments thereto provided herein have an actual effect on Amaya’s operating results.

In addition to QNY, which is defined below under “Key Metrics and Other Data”, Amaya uses the following

non-IFRS and non-U.S. GAAP measures in this release:

Adjusted EBITDA means net earnings (loss) before interest and financing costs, income taxes, depreciation

and amortization, stock-based compensation, restructuring and certain other items.

Adjusted Net Earnings means net earnings (loss) before interest accretion, amortization of intangible assets resulting from purchase price allocation following acquisitions, deferred income taxes, stock-based compensation, restructuring, foreign exchange, and certain other items. Adjusted Net Earnings per Diluted Share means Adjusted Net Earnings divided by Diluted Shares. Diluted Shares means the weighted average number of common shares on a fully diluted basis, including options, warrants and Amaya’s convertible preferred shares. The effects of anti-dilutive potential common shares are ignored in calculating Diluted Shares. See note 7 to the Q1 2017 Financial Statements. For the three months ended March 31, 2017, Diluted Shares equaled 200,656,549. For the purposes of the full year 2017 financial guidance provided in this release, Diluted Shares equals between 202,000,000 and 206,000,000 for the high and low ends of the Adjusted Net Earnings per Diluted Share range, respectively.

To calculate revenue on a constant currency basis, Amaya translated revenue for the three months ended March 31, 2017 using the prior year's monthly exchange rates for its local currencies other than the U.S. dollar, which Amaya believes is a useful metric that facilitates comparison to its historical performance.

For additional information on Amaya’s non-IFRS measures, see the Q1 2017 MD&A, including under the

headings “Management’s Discussion and Analysis” and “Selected Financial Information—Other Financial

Information”.

Key Metrics and Other Data

Amaya defines QAUs as active unique customers (online, mobile and desktop client) who generated rake, placed a bet or otherwise wagered (excluding free play, bonuses or other promotions) on or through an Amaya poker, casino or sportsbook offering during the applicable quarterly period. Amaya defines unique as a customer who played at least once on one of Amaya’s real-money offerings during the period, and excludes duplicate counting, even if that customer is active across multiple verticals (e.g., both poker and casino). For further clarity, the exclusions from QAUs noted as “free play, bonuses or other promotions” include, without limitation, low-stakes and/or non-raked poker games, but do not include non-cash promotions or poker tournament fees covered by Amaya as incentives for customers who ultimately make or place real-money wagers or bets on or through an Amaya poker, casino or sportsbook offering.

Amaya defines QNY as combined real-money online gaming and related revenue (excluding certain other revenues, such as revenues from play-money offerings, live events and branded poker rooms) for its two business lines (i.e., real-money online poker and real-money online casino and sportsbook) as reported during the applicable quarterly period (or as adjusted to the extent any accounting reallocations are made in later periods) divided by the total QAUs during the same period. Amaya provides QNY on a U.S. dollar and constant currency basis. QNY is a non-IFRS measure.

Amaya defines Customer Registrations as the cumulative number of online real-money and play-money

customer registrations on PokerStars, Full Tilt and related brands.

For additional information on Amaya’s key metrics and other data, see the Q1 2017 MD&A, including

under the headings “Limitations on Key Metrics and Other Data” and “Key Metrics”.

For investor relations, please contact:

Tim Foran

Tel:

+1.416.545.1325

ir@amaya.com

For media inquiries, please contact:

Eric Hollreiser

Press@amaya.com